Annual Financial Review

27 September 2024 Read time >10 min.

Financial management

The University of Cape Town (UCT) places significant emphasis on effective financial management to ensure a combination of best practices, responsible stewardship, and forward thinking. This approach aims to provide the university with the necessary financial resources to fulfil its objectives. UCT's comprehensive financial plan encompasses seven distinct yet interconnected components:

- Continuing educational operations

- Research and other operations reliant on specific funding

- Student housing operations

- Investment income and financing expenditure

- Capital expenditure

- Capital structure and financing

- Cash flow planning

Financial policy

The University’s financial policy is designed to ensure the long-term financial sustainability of the institution, as outlined in the following policy statement: “Our financial policy aims to support sustainable operations and enable investments in educational initiatives that align with our mission. We adopt a conservative approach to financial management, striving for efficient recurrent operations that generate funds to support strategic initiatives.” UCT operates within a multi-year framework, and the financial policy is implemented by integrating the following key areas:

Break-even target: Although the applicable policy aims to generate a surplus from Council-controlled recurrent operations to fund new initiatives and provide a buffer against unforeseen circumstances, this was not the case for 2023 where we generated a loss of R349.29 million. The position improves to a budgeted deficit of R220 million for 2024. Per the amended policy, and within the following three years while operating within the constraints as articulated in our financial sustainability plan, we aim to target a break-even on Council-controlled recurrent operations.

Capital expenditure: Our capital expenditure is guided by the strategic framework and limited by available cash resources and borrowing capacity, ensuring affordability.

Debt finance: Debt finance is used conservatively, taking into account the ability to service both interest and capital repayments.

Investment income: Given its volatile nature, investment income, after deducting all financing costs, is solely allocated to seed new initiatives and support other strategic choices. By adhering to this financial policy and implementing these integrated approaches, UCT strives to achieve financial sustainability, support its operational needs, and invest in initiatives that align with its mission.

Cash flow planning

Effective cash flow planning is essential for the UCT to manage its financial resources efficiently. The cash flow at UCT is very cyclical and exhibits a low point at the end of January, with a peak in July/August, coinciding with the receipt of most fees and subsidies. It is imperative that we exercise careful planning and management of our cash flow to generate investment income and facilitate the execution of projects. We have established cash management committee chaired by the Chief Financial Officer (CFO) to closely monitor our cash utilisation and needs against available cash. The committee meets monthly and accounts to University Finance Committee (U)FC via the executive committee.

Sustainability

The achievement of our strategic goal of financial sustainability relies on the recurrent operations of the university and the availability of free cash reserves. Although our operating margin is low, the associated risk is partially mitigated by the knowledge that a significant portion of our income, comprising subsidies and fees, is received early in the operating cycle. If these inflows deviate significantly from our projections, we can promptly react and make necessary adjustments to our operations.

As part of the preliminary university's financial sustainability plan, UCT has identified specific projects that aim to enhance its revenue generation while focusing on the core areas of teaching, learning, and research. Consequently, a comprehensive review of our current investments in the third income stream is underway to ensure strategic alignment with the university's goals and long-term financial viability. In addition, given the deficit of R349.29m in 2023 and the budgeted deficit of R220m for 2024, in May 2024 we have constituted an internal project team to formulate a multi-year approach to address this significant issue. In addition, we have appointed an external service provider to assist this team with project management, starting with a full diagnostic, planning and then the execution of this financial sustainability plan.

Despite our efforts, there are certain concerns that warrant our attention. The lower than inflation fee increases, the mounting pressure on the state to fulfil its funding commitments, rising inflation driving cost increases and our wage and salary commitments remain significant drivers that require vigilance. These events and uncertainties serve as a constant reminder against complacency and emphasise the importance of maintaining our free cash reserve target, along with staying informed about economic outlooks and challenges faced by the state.

In conclusion, UCT recognises the significance of effective revenue, cost and cash flow management in maintaining financial stability and pursuing sustainable growth. By implementing prudent financial strategies, monitoring economic conditions, and adapting to evolving circumstances, we aim to navigate potential challenges and secure the long-term success of our institution.

2023 Financial highlights

Financial Performance

In 2023, the total revenue of the university increased by 11.2% compared to the previous year, reaching R8.63 billion. This growth was primarily driven by income from contracts (eg research contracts), sale of goods and services (eg hotel accommodation and short courses fee income) and donations and gifts. In 2022, the total revenue stood at R7.76 billion, reflecting a growth rate of 10%.

Net fee income, which excludes bursaries, scholarships, and financial aid adjustments, increased by 1.3% in 2023. The net fee income for 2023 amounted to R2.03 billion, compared to R2.01 billion in 2022, representing a growth rate of 1.3% in the previous year.

Income from state appropriations experienced a further decline in 2023, of 3.4%. The university received R2.17 billion from state appropriations in 2023, while the corresponding figure for 2022 was R2.24 billion, reflecting a marginal decrease of 2%.

The income from contracts as well as sale of goods and services made significant contributions to the overall revenue increase with a growth rate of 14.4% and 35.3% respectively in 2023. The income from contracts amounted to R1.77 billion while sale of goods and services amounted to R1.21 billion in 2023. This was up from R1.55 billion and R897 million respectively in 2022.

On the expenditure side, which includes personnel costs and other operating expenditure, there was a 12.3% increase in 2023. The total expenditure for the year amounted to R8.28 billion, compared to R7.37 billion in 2022, reflecting a growth rate of 9.2% in the previous year.

Excluding investment income and fair value movements on financial instruments, a deficit of R342.3 million was incurred in 2023, compared to a deficit of R196.4 million in 2022. This is attributable to the revenue line growing at a lower rate compared to costs and attributable significantly to lower enrolments and salary costs increases at rate higher than tuition fees.

The consolidated operating surplus after investment income showed a significant increase in 2023 versus a substantial decrease of 94.1% in 2022. This surplus for 2023 amounted to R1.04 billion, up from R80.8 million in 2022.

In 2022, there was a significant decrease in cash while the university generated R217.9 million in cash in 2023, compared to the R223.5 million utilised in 2022.

Total assets increased by 8.8% in 2023 representing a total of R16.79 billion in 2023, up from R15.44 billion in 2022. Out of the operating surplus of R1.04 billion, R1.44 billion is attributable to restricted funds that are not under the discretion of the Council.

The net surplus of R1.04 billion includes deficits of R349.29 million from Council-controlled activities and R49.7 million from the student and staff housing operations.

Statement of Financial Position

In the current fiscal year, the total assets of the university increased by 8.8%. This increase can be attributed to several significant factors within our financial landscape. Notably, there was an increase of 3.7% in Property, Plant, and Equipment (PPE) and 9.3% in investments compared to the previous year's growth rate of 4% for PPE and a decrease of 9% for investments. The rise in PPE can primarily be attributed to the purchase of land purposed for student accommodation, as well as projects related to planned and backlog maintenance. Investments witnessed a substantial increase of 9.3% compared to a slight increase of 1.1% in the previous year. This increase is mainly due to the better performance noted in the markets, despite concerns regarding the outlook for local economic growth and the impact of higher interest rates.

Another notable change is the increase of 20% in current assets, contrasting with a decrease of 10% in the previous year. The most significant contributor to this growth is the increase in cash and cash equivalents by 32.4%. This increase in cash is primarily attributed to the timing of the payment of bonuses, as opposed to the previous year where bonuses were paid in the month of December as well as the timing of planned capex.

It is essential to highlight that a substantial portion of our non-current assets are designated, and the Council has no discretionary control over them. These assets, which amount to R4.4 billion, constitute 26% of our total assets for the current fiscal year, slightly higher than the R4.3 billion reported in 2022. Moreover, it is crucial to note that the approval of the Minister of Higher Education and Training is required for the alienation, including the sale of any immovable properties.

Regarding our investments, approximately 60% of the portfolio is held by the UCT Foundation and is allocated to specific activities. The remaining balance is held within the university operations, with 80% of these funds designated for specifically funded restricted activities.

A concerning aspect of our financials is the recurrent increase in student fee receivables, particularly due to the fact that 13% of this debt is over 12 months overdue. The gross student fee outstanding for the current year was R594 million, which represents an increase of 25% when compared to the prior year (R476 million). Given the worsening in factors affecting the ability of students to settle outstanding debt, the provision for credit losses regarding student debt has increased by 46% in the current, from R166 million to R241 million (2022). The management team acknowledges the importance of addressing this issue and emphasises that student fee debt collection remains a key focus. We recognise that the negative economic outlook may impact the timing and effectiveness of our collection efforts in addition the concessions that have been made over the years.

In terms of our financial position, the university maintains a healthy gearing ratio, with liabilities totalling R3.27 billion against total assets of R16.79 billion, resulting in a debt ratio of 0.19. It is noteworthy that the university did not increase its long-term borrowings in 2023 but rather continued to settle the total drawdown of R110 million from the Development Bank of Southern Africa (DBSA) loan facility. This loan, utilised for the funding of the conference centre at the Graduate School of Business (GSB), is scheduled for repayment over a 10-year period, with the university currently in its 6th year of repayment.

In conclusion, the increase in total assets, along with the changes in specific categories, highlights the financial dynamics of the university. We remain committed to managing our financial resources prudently, addressing the challenges in student fee collections, and ensuring the sustainability and growth of the institution.

Statement of Comprehensive Income

Council Controlled Unrestricted Operations

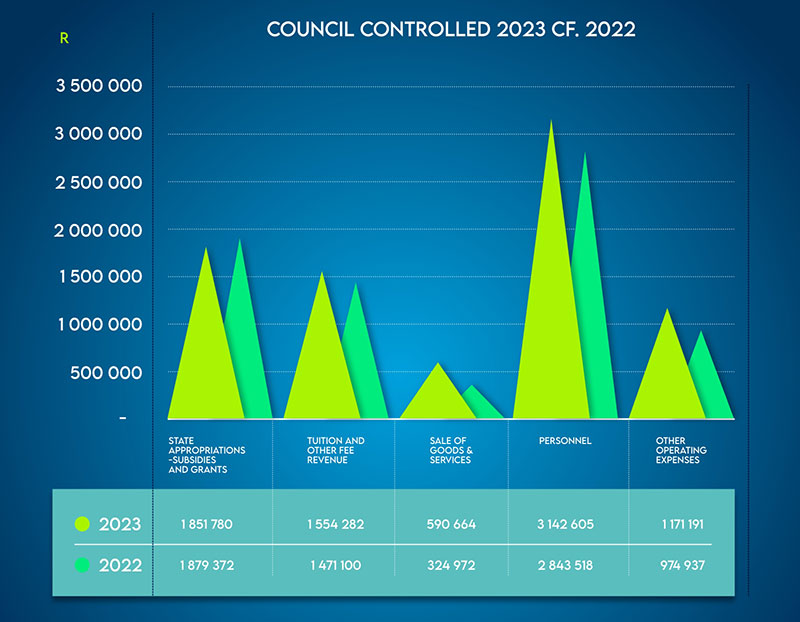

Council Controlled Unrestricted operations, which encompass the primary recurring operating activities that provide and support teaching and learning, exhibited notable changes in key financial data. Specifically, in relation to these operations, the total operating income increased by R333.9 million (9.1%) to reach R4.01 billion. This increase was primarily driven by a rise in the sale of goods and services and tuition fee income, amounting to R265.69 million (81.8%) and R83.18 million (5.7%) respectively. However, state appropriations saw a decrease of R27.59 million (1.5%).

The decline in state appropriations can be attributed primarily to the claw back from the DHET which was advised to the sector end October 2023. On the other hand, the increase in sale of goods and service primarily stems from third-party revenue and commercial activities, including our accommodation-related entities such as two Marriott-operated hotel properties, vacation accommodations, and the conference centre at the GSB. The continual increase in revenues related to these activities reflects the stabilisation of the hospitality and has facilitated the resumption of business activities, leisure travel, and conferencing.

Tuition fees are offset against UCT council and restricted funding financial aid and bursaries, as mandated by the International Financial Reporting Standards (IFRS). Before accounting for the IFRS adjustments, tuition income amounts to R1.70 billion, indicating an increase of R78.27 million. At the net level, considering the required adjustments, tuition revenues increased by R83.18 million or 5.7%. This growth in tuition fees can primarily be attributed to the fee increase applied.

Expenditure reflected an above inflation increase of R526.16 million (12.8%) to reach R4.67 billion, primarily driven by a rise in personnel costs amounting to R299.09 million (10.5%) and an increase in other operating costs of R196.25 million (20.1%). The main driver behind the increase in personnel costs is the filling of vacant permanent positions and the cost-of-living increment agreed with unions.

Financial support provided to our undergraduate students amounted to a total of R1.80 billion, down from R1.93 billion in 2022. This support is derived from various sources, including corporate and external bursaries amounting to R360 million, grants provided by NSFAS totalling R655 million, and an additional R688 million from council-controlled funds provided by UCT (of which R62.8 million has been offset against tuition fee income). Furthermore, income from endowments and other funds available to the university for financial aid purposes contributed R100.82 million.

Upon excluding the effects of the IFRS15 offsetting of designated bursaries against Council-controlled tuition income, as well as net finance income, the council-controlled recurrent operations resulted in a deficit of R538 million, following the deficit of R346 million in 2022. At a high level, this substantial increase in the deficit can be largely attributed to the significant rise in personnel costs and the decrease in state appropriations income resulting from the sector wide claw back by the DHET. This increase in deficit highlights the urgent need for a comprehensive financial sustainability plan.

The university had Capital expenditure (Capex) of R386 million in the current year, in comparison to R409 million in 2022. The decrease in Capex spend was largely attributable to a decreased spend relating to strategic and once off allocations, as well as ICTS related projects.

The actual deficit attributable to Council-controlled unrestricted funds, as reflected in the Consolidated Income Statement on page 96, amounts to R349.29 million, compared to a deficit of R121.68 million in 2022. In both years, investment income played a major role, contributing R268 million (R221 million in 2022) to the difference between the mentioned deficits in both years.

Specifically funded activities restricted operations

Specifically funded activities restricted encompass research and other specifically funded initiatives that typically lie outside the purview of the university management. Although decision-making authority may be retained in terms of governance, monitoring, and occasionally approval, these activities introduce additional risks to the university. These risks primarily stem from limited decision rights concerning cash flows, accounts receivable management, and infrastructural support. Moreover, the growing complexity of compliance and reporting requirements associated with research contracts amplifies these risks, necessitating additional resources to mitigate them.

In the fiscal year, the university witnessed a significant increase in revenues, with a notable surge of 16.25% amounting to R534.3 billion. Government-related grants experienced a decline of 13.4%, decreasing from R365.06 million to R316.02 million, while income from contracts exhibited a notable growth of 14%, rising from R1.55 billion to R1.77 billion. This surge in research activity, which has persisted over an extended period, has placed substantial demands on core administrative departments. Unfortunately, these departments have received limited resource allocations to effectively manage this growth, leading to an increased risk of reputational damage.

As a research-intensive university, securing funding for research activities remains a strategic imperative. Therefore, it is crucial to establish robust systems and employ capable personnel to facilitate research and attract sustainable research funding. The university’s research-related activities have witnessed consistent growth over the years, surpassing the R1 billion milestone in 2014. The current research-related revenue, comprising grants and contract income, stands at R2.09 billion (2022: R1.91 billion), representing 55% of the total specifically funded activities valued at R3.82 billion. Additionally, research-related revenue accounts for at least 24% of the university’s total income.

Analysing the broad categories of funding, contract income amounts to R1.77 billion (2022: R1.55 billion), constituting 46% of the research revenue. Government grants contribute R316.02 million (2022: R365.1 million), accounting for 8% of the research revenue. Research-related donations total R740.62 million, indicating a significant increase of R263.7 million compared to 2022.

Student housing restricted operations

The Student Housing unit is committed to meeting its financial obligations, ensuring long-term maintenance, and expanding student housing availability to enhance student access. Notably, total revenues experienced an 8.4% decrease, reaching R524.28 million. The unit reported a deficit of R49.65 million, which represents a further decline when compared to the deficit of R22.90 million recorded in 2022. The increase in deficit was primarily due to the lower residence fees, increase in the rental fee related to student accommodation, and increased catering costs due to increased SCM fees.

Statement of cash flows

In terms of the statement of cash flows, the operations resulted in a net inflow of R217.94 million (compared to a net outflow of R223.5 million in 2022) for the year, representing an increase of 198% when compared to the previous year. Several factors contributed to this variance, including a substantial increase in cash received from research contracts amounting to R223 million, an indication of an increase of activity in the research space. Additionally, there was an increase in sale of goods and services by R317 million, primarily due to a general increase in hotel and short course revenue, as well as the settlement of the insurance claim in relation to the UCT fire. Furthermore, donations and gifts received increased by R276 million, mainly driven by the positive outcome resulting from fundraising initiatives.

Future challenges – 2024 and beyond

Looking ahead to 2024 and beyond, several challenges continue to loom on the horizon. The economic outlook remains challenging, aligning with previous assessments. Notably, the anticipated changes in the state subsidy and tuition fee model may significantly impact UCT's financial results and position. However, the specific details and implications of these changes are yet to be published by DHET.

Three key variables continue to have a substantial impact on UCT's financial sustainability. These variables are the state subsidy and tuition fees as income sources, as well as human resources planning and staffing models as expenditure factors. Furthermore, the decline in allocations from the state to the National Student Financial Aid Scheme (NSFAS), coupled with an increasing number of qualifying students, has necessitated changes to NSFAS funding criteria, resulting in a significant decline in per capita funding. This poses an additional challenge for UCT, given its large cohort of financial aid students.

To address these challenges, UCT initiated the development of a Financial Sustainability Plan in late 2019, encompassing a ten-year period with three to five-year medium-term forecasts and annual rolling plans. The plan's first phase was completed and submitted to Council in June 2022, followed by a Leadership Lekgotla workshop in October to initiate the development of an implementation plan. Subsequently, a Financial Sustainability Project Management Office was established, which responsible to a Steering Committee chaired by the Vice-Chancellor and accountable to Council via UFC. An external consultancy partner has been appointed via a tender process to support the work of the project office over the next three years. The anticipated impact of these initiatives is incorporated into the medium-term financial outlook.

Key risks and contexts

- State subsidies: The state has been under severe pressure to meet its subsidy obligations and undertakings to the sector. In April 2021 we had an unexpected cut, and while the block grant had been protected for 2022, and as referred to previously, our allocation in 2023 was lower than that received in 2022. This has seriously impacted the growth trajectory for state funding in this model. In addition, with funding shortfalls expected at NSFAS, with annual increases that clearly do not account for the volume growth in students qualifying for funding, DHET is likely to divert unspent funds to support NSFAS or we will see yet again NSFAS responding through changes in funding policies (see further note below on NSFAS).

- Student fees: The DHET Fee Regulation Task Team has been in existence for six years. Its work was severely disrupted by the COVID-19 pandemic as DHET, and higher education institutions needed to focus on managing core functions under lockdown and pandemic restrictions. The task team reconvened in September 2021, given DHET wanted to implement the framework for 2022. Following debate, it was accepted that this was not going to be possible and DHET is now aiming for a 2025 implementation date. This will deal only with tuition fees, with residence fees to follow in due course. It is hard to comment on the timelines for implementation, but what is evident is that the framework will further limit our ability to increase fees.

- NSFAS: While free higher education via NSFAS has meant the state covers the fees of more students who attend UCT, it has made us more reliant on the state in respect of our two primary income sources – state subsidy, and tuition and residence fees. With R1.72 billion in subsidy expected in 2024, and roughly 50% of fees expected to be settled by NSFAS, a sizeable proportion of our recurrent revenue is aligned to the MTEF fortunes of the state.

- Student enrolment and retention: UCT needs to continue to improve on its ability to recruit and enrol new students and improve on its throughput rates for students in the system. Several interventions aimed at improving retention/progression rates are already underway and others are being considered and evaluated. Ramping up the recruitment and enrolment of international students is also a specific focus area. These are key sustainability interventions that form part of the sustainability plan as well as Vision 2030.

- Credit load / academic workload: Work has continued reviewing and revising academic credits on courses and better understand the key costs of delivery to best inform key resource allocation decisions. The Deputy Vice-Chancellor (DVC) for Teaching and Learning and her team started work on this in 2020 with a view to curriculum reform. It is evident that we teach more credits than is required by frameworks and norms, and that these additional credits need staff to teach them and students to learn. This leads to overload of students and overload of staff. The work is ongoing and forms part of our financial sustainability initiatives.

- Staffing: The DHET and various other national higher education regulatory bodies have various staffing percentage benchmarks they refer to as being appropriate. Most are expressed as a percentage of total costs. In respect of our teaching and related budget for 2024, our total staffing and related costs are at 68.7% of total spend (and 72.2% of recurrent income). Benchmarks range between 55% to as high as 70%, with local institutions primarily in the 55% to 60% band. While we have operated at a high percentage for several years, unless we are able to improve our revenue outlook and delivery, we have little choice but to look at our operating costs in general and staffing costs in particular. Given the quantum and relative percentage spent on our staffing bill, it will be almost impossible to remain sustainable without reviewing human resource planning, staffing models or pay increases consistently at rates below inflation. This is a key subset of long-term financial sustainability.

- Council-controlled teaching and related operations bottom line: The forecast period indicates a significant deficit for 2024, but thereafter, if our financial sustainability interventions gain the necessary traction and deliver on expectations, particularly an acceleration in reducing staffing costs, a turnaround is expected, with 2025 targeting break-even and 2026–2029 showing small surpluses. However, small changes in the rates of increase for state subsidy, tuition fees and staffing can alter the bottom-line value materially in a noticeably short space of time.

Key is that the focus on improving retention and throughputs improves both state subsidy and tuition fee revenues, while getting the credit and workload model resolved, improve the ability of our staff to undertake research, but also reduce the need for additional staff.

Of note, specifically in relation to our projected free cash balance at the end of each year in the cycle, is that despite an improving annual surplus, this does not result in a recovery of cash depletion over this period, with a projected December closing balance of circa R400 million from 2026 onwards. In effect, the operating surpluses from 2026 onwards together with the reduced net investment income is just sufficient to fund projected capital and strategic investments over the period, but not to replenish the cash reserves depleted during the 2022–2024 period of significant operating deficits. Given what is modelled at present, the return of the free cash position to within the target range of 15% to 30% of recurrent operating costs for the majority of the periods in our annual cash cycle, will require a longer timeframe to achieve.

Despite these challenges, we maintain an optimistic outlook. Our track record of effective financial management and accurate forecasting, coupled with our strategic interventions outlined in our medium-term financial sustainability plan, instils confidence that UCT will successfully navigate the current economic landscape. Our plans are further supported by a well-tested university integrated financial plan.

Through these measures, we aim to uphold our commitment to excellence in teaching and research, ensuring that UCT remains at the forefront of academic achievement.

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

This work is licensed under a Creative Commons Attribution-NoDerivatives 4.0 International License.

Please view the republishing articles page for more information.

Annual reviews

Year in Review 2023

27 Sep 2024

Year in Review 2023

There are different ways to define the University of Cape Town (UCT).

27 Sep 2024 - 2 min read

By its very nature, the university sector is a place of transition.

27 Sep 2024 - 4 min read

In a world whose future relies increasingly on international co-operation and global thinking, developing and maintaining strong partnerships with institutions in other countries can be a game changer for research that addresses the wicked problems that have become household words in the last few years.

27 Sep 2024 - >10 min read

Previous Editions